EU battery regulations: what do the new rules mean?

The European Green Deal, a set of policy initiatives approved in 2020, aims for a sustainable and competitive economy with net-zero greenhouse gas emissions by 2050. Along with the legislation driving this transition, such as the Energy Efficiency Directive recast (see EED comes into force, creating an enormous task for the industry), the strategy will require much higher rates of electrification in transport and industries to displace the use of fossil fuels. This aim is combined with the policy objective of adding large amounts of renewable power generation capacity.

However, this direction is leading toward a new environmental challenge: increased sales of electric vehicles (EVs) will create future end-of-life battery problems, drawing attention to the unresolved issue of reusing and recycling large battery banks. Many industrial stationary applications are also seeing a strong take-up of EV-type (mostly lithium-ion) batteries for a variety of reasons. These include the displacement of valve-regulated lead-acid (VRLA) batteries, which are highly recycled, new energy storage installations for grid demand-response schemes and the elimination of standby engine generators.

Until now, this area has been governed by the 2006 Battery Directive (2006/66/EC). However, this directive is being replaced by Regulation 2023/1542 — the main objective of which is to create an updated set of rules to ensure high sustainability standards regardless of the battery chemistry. As an EU Regulation, it applies automatically to all member states without implementation in national laws.

The new regulations address aspects such as carbon footprint, recycled content, safety, labeling and end-of-life management. Industrial customers, including data center suppliers and their customers, will need to start reporting by mid-2025 — although this date may yet change. Although these rules only apply to members of the EU, its standards and laws are often replicated in other countries.

The 2006 Battery Directive was put in place to mitigate the environmental impact of battery production and disposal of waste batteries. It introduced recycling and treatment targets, restrictions on some hazardous substances, labeling requirements (for hazardous substances and instructions for proper disposal), reporting obligations and extended producer responsibility.

Lead-acid versus Li-ion recycling: the facts

The most common batteries used in uninterruptible power supply (UPS) systems are VRLA and Li-ion batteries (of which several sub-types exist). Lead-acid batteries have the highest collection and recycling rates. In the EU, the recycling rate for automotive starter batteries is 99% and more than 90% of the lead is recovered. The figure for stationary applications, which includes data centers, is likely to be similarly high due to the stringent regulations and economic incentives to recycle.

In 2021, all EU member states met the target recycling rate of 65% by weight for lead-acid batteries (both automotive and non-automotive).

The recycling process of lead-acid batteries consists of draining the electrolyte, opening the casing and separating the materials. The lead plates are then smelted to obtain molten lead, which is purified and refined before being cast into ingots for reuse. The plastic components are also recycled. Lead-acid batteries have few components and contain approximately 70% lead, which means that it is an efficient process. It is also profitable because recycled lead can be used in the manufacture of new batteries and is recyclable at relatively low temperatures, which require less energy.

For Li-ion batteries, the view is more complicated. Currently, it is cheaper to mine the metals to make new Li-ion cells (regardless of Li-ion chemistry) than it is to recycle used batteries. As a result, the much higher environmental footprint of the supply chain to produce Li-ion cells has so far been an externality and not priced into the cost of making Li-ion batteries. This factors heavily into its current market advantage in price-performance compared to other, environmentally less damaging cell chemistries.

The two most common processes for recycling spent Li-ion batteries are pyrometallurgy and hydrometallurgy. During both processes, the batteries are discharged and dismantled. They are then either smelted at high temperatures or leached to recover high-value cathode materials, such as cobalt, nickel and copper. During pyrometallurgical smelting, the lithium is lost in the furnace, making the process for lithium not sustainable. Future recycling processes for Li-ion cells are in development and will likely involve a combination of heat treatment and leaching in various concentrations of acid to maximize recovery of valuable metals.

These processes are energy-intensive and therefore expensive to operate, as well as producing gaseous pollutants and industrial waste. According to some battery vendors, the costs involved with the transport and recycling of Li-ion batteries, which is considered a hazardous waste, are substantial.

This is a major reason behind the current expectation that Li-ion battery packs will find secondary and even tertiary uses rather than being recycled for their raw materials. Compared with lead-acid batteries, this is possible due to Li-ion cells’ higher endurance and shelf life. The new battery regulation actively considers this scenario with the introduction of battery passports.

What are the new rules?

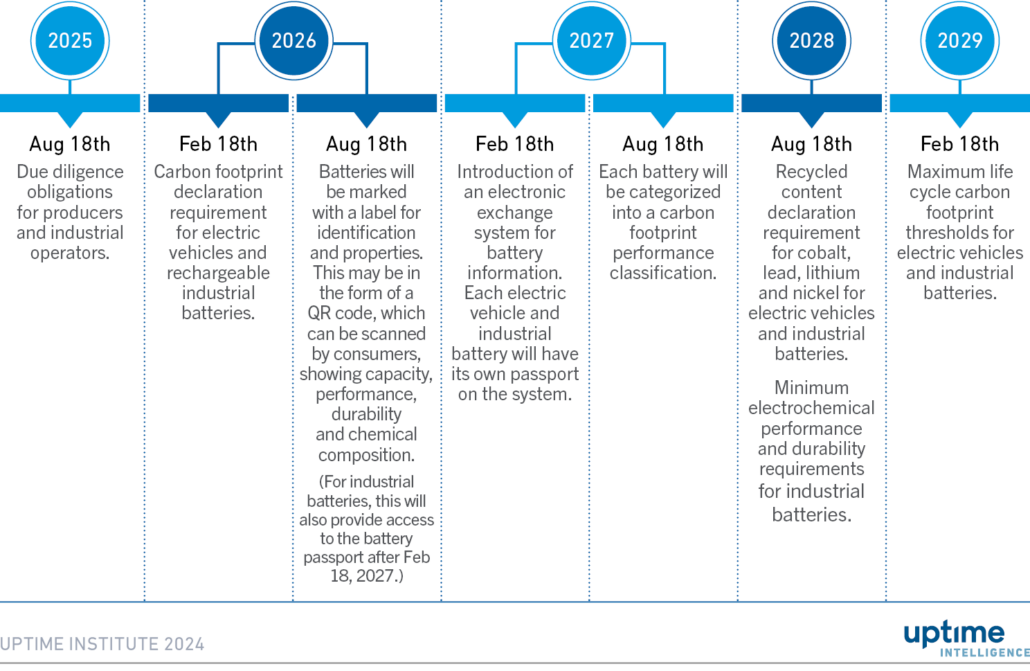

The phased implementation of the rules (Regulation 2023/1542) begins in July 2024 and regulates the carbon footprint, recycled content of new batteries, labeling and the introduction of an online battery information system. The new battery regulation controls all battery chemistries, with rules varying by battery category, for example, EV, industrial and portable. Recycling targets differ between chemistries, with specific targets for the recovery of cobalt, lead, lithium and nickel. Figure 1 sets out the major milestones of the regulatory rollout for EU member states, as prescribed in the regulation.

Figure 1. Timeline of the EU’s battery regulation

New batteries put to market will be subject to mandatory minimum levels of recycled content requirements. From 2030, batteries will need to contain a minimum recycled content of 12% for cobalt, 4% for lithium, 4% for nickel and 85% for lead. By 2035, these thresholds will increase to 20% cobalt, 10% lithium, 12% nickel and 85% lead.

Alongside these requirements, there are also recycling efficiency and material recovery targets for end-of-life batteries. By the end of 2030, used batteries will have a recycling target by weight of 80% for lead-acid and 70% for Li-ion. The material recovery target is 95% for cobalt, copper, lead and nickel and 70% for lithium.

What does this mean for data center operators?

The new rules will mostly affect battery producers; however, some responsibilities will fall on end users, such as data center operators. These include performing due diligence to verify vendor (product carbon footprint) and recycler claims (environmental credentials of the recycling process), as well as maintaining up-to-date battery passports during the use of the products.

From August 18, 2025, battery suppliers and data center operators (with some exceptions), will have a legal requirement to adopt a battery due diligence policy covering the social and environmental risks. This policy will need to include annual reports on the risks in the supply chain and the steps taken to manage them, transparency on sourcing raw and recycled materials, and structuring an internal management system to support it. The due diligence policy should be verified by a third party and communicated to suppliers and the public via annual reports.

There are exceptions for suppliers and buyers of batteries with an annual net turnover of less than €40 million ($43 million) and those using batteries that have undergone preparation for reuse, repurposing, or remanufacturing before being placed on the market.

The introduction of battery passports in 2026 will affect both suppliers and end users, including data center operators. Battery producers will be required to report on properties such as the chemistry, carbon footprint and recycled content, while it will be the end user’s responsibility to update the battery passport on the state of its health throughout its life. This will likely include maintenance entries but also any substantial events or accidents, such as deviations from standard operating environmental conditions, overcharging or deep discharging, and other impacts.

Battery passports will be key to enabling a second-hand market for batteries that are appropriate for reuse. Alongside the labeling of batteries, this may lead to improvements in Li-ion battery recycling by simplifying the separation process by sorting batteries by chemistry before the start of the recycling process. However, the technical implementation of the battery passport has not been stipulated in the new regulation and will be left to future cooperation between EU member states.

The regulation states that producers shall cover the necessary costs incurred by the collection and recycling of waste batteries. Lead-acid batteries have an inherent economic value at the end of their useful lives, which guarantees incentives for both buyers and sellers to promote recycling. Li-ion batteries, however, currently incur substantial costs to pay for recycling. According to battery makers, this can amount to as much as the price of new Li-ion batteries. Another potentially overlooked detail is the cost of transporting large amounts of Li-ion batteries that are classified as hazardous and pose a fire risk.

It is possible (or even likely) that end users may see a marked increase in the price of Li-ion batteries — the selling price will need to cover the recycling costs as a result of this extended producer responsibility. Data center operators, with hundreds of batteries in their UPS systems, may have to set up databases and processes to ensure they are reliably tracked.

The regulation stipulates that the ultimate responsibility for managing end-of-life batteries will fall on suppliers — in practical terms: taking batteries from end-users for no charge and ensuring the batteries are reused or recycled. However, end users should also exercise due diligence, even when they are not legally required to at present. Data center owners and operators should be aware that battery manufacturers may overstate their recycling capabilities. This is particularly relevant given the long lifespan of industrial Li-ion batteries, which can remain in use for 10 to 15 years or longer. Companies placing such batteries on the market may not have adequate recycling plans in place.

End users should also consider what technology is used in the recycling facilities, and even verify the existence of these facilities by checking their reported location using satellite imagery and public records. Inevitably, some battery vendors will go out of business, leaving end users with a potentially costly liability.

Additionally, when considering Scope 3 emissions reporting (in accordance with the Greenhouse Gas Protocol), the new recycling obligations add complexity. End users will need to consider carbon emissions from transportation and recycling processes. While some may argue that recycling offsets carbon emissions compared with manufacturing new batteries from raw materials, this claim may not withstand closer scrutiny.

Where could these rules go in the future?

The 2023 battery regulation provides a timeline of implementation, but the rules will need further clarification when they start to come into effect. Potential secondary legislation could involve standardizing calculations for carbon footprint, recycling efficiency and material recovery. More clarification may follow for the implementation and functioning of the electronic exchange system as well as specifications for the content and accessibility of battery passports.

Additionally, EU member states may choose to enact further requirements (as long as they are not in conflict with EU law) to stimulate investments in research and development related to carbon footprint reduction and sustainability in battery production and recycling.

The Uptime Intelligence View

The new EU Battery Regulation is primarily a response to the mass-market adoption of EVs, however, it also covers industrial stationary applications, such as mission-critical power systems.

The EU’s objective is to ensure that huge quantities of new batteries will not simply end up as hazardous waste at the end of their lives but will either find new uses or be recycled to make new battery cells. It will also level the playing field with lead-acid batteries and other, more readily recyclable chemistries.

Rosa Lawrence, Research Associate, Uptime Institute, rlawrence@uptimeinstitute.com

Daniel Bizo, Research Director, Uptime Institute, dbizo@uptimeinstitute.com

2020

2020

2019

2019