Green tariff renewable energy purchases

Until recently, power purchase agreements (PPAs) and unbundled renewable energy certificates (RECs) were the primary means for data center operators or managers to procure renewable electricity and RECs for their operations. Many companies are not comfortable with the eight-to-20-year length and financial risks of a PPA. Unbundled RECs are an ongoing expense and do not necessarily help to increase the amount of renewable power generated.

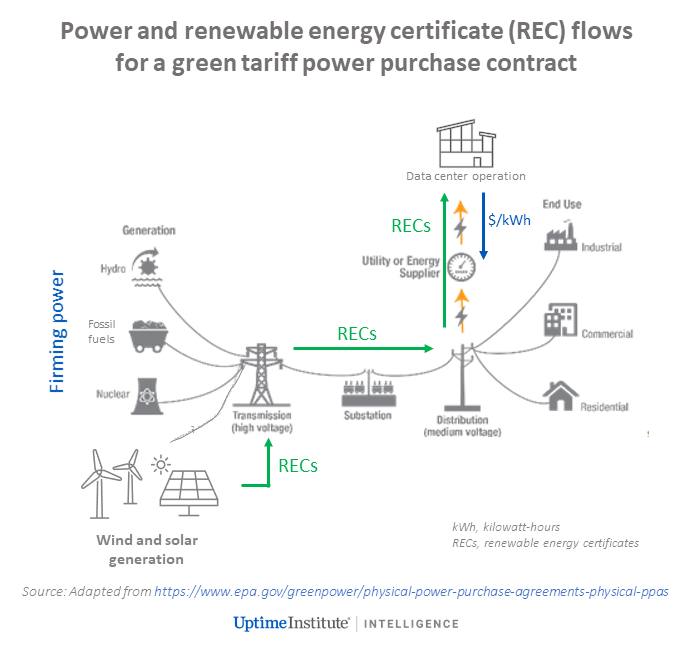

As the supply of renewably generated electricity has grown across markets, utilities and energy retailers are offering sophisticated retail renewable energy supply contracts, referred to as green tariff contracts, which physically deliver firm (24/7 reliable) renewable power to data center facilities. The retailer creates a firm power product by combining renewable power, brown power (fossil fuel, natural gas and nuclear) and RECs from a defined set of generation projects within the grid region serving the facility.

The base of the contract is committed renewable generation capacity, which delivers the megawatt-hours (MWh) of electricity and RECs, from one or more renewable energy projects. Brown power is purchased from the spot market to fill supply gaps to ensure 24/7 supply at the meter (see schematic below). All the power purchased under the contract is physically supplied to the data center operator’s facility and matched with RECS.

In contrast to PPAs, these contracts have typical terms of four to eight years; charge a retail price inclusive of transmission, distribution costs and fees; and physically deliver 24/7 reliable power to the consuming facility. Perhaps most importantly, the financial and supply management risks inherent in a PPA are carried by the retailer. This relieves the data center operator or manager of the responsibility of managing a long-term energy supply contract. In exchange for carrying these risks, the retailer receives a 1% to 5% premium over a grid power supply contract. Paying a fixed retail price for the life of the contract brings budget certainty to the data center operator. The contract term of four-to eight years better fits the business planning horizon of most data center operators. It eliminates the uncertainty associated with estimating the location, size and energy demand of a data center operations portfolio over the full term of a 20-to-25-year PPA.

The use of green tariff contracts often does not enable the purchaser to claim additionality for the renewable electricity purchases, which may be important for some. Many green tariff contracts procure energy from older hydro facilities (in the US and France), from generation facilities coming off subsidy (in the US and Germany) or from operating generators that are selling into the spot market and are looking for a firm, reliable price over a defined period for their output (in the US, EU and China). These latter situations do not satisfy the additionality criteria. But in situations where the contract procures renewably generated electricity through a new PPA or a repowered renewable energy facility, additionality may be claimed.

But most importantly, green tariff contracts do allow data center operators to claim that they are powering their facility with a quantified amount of MWhs of renewably generated power and that they are matching their brown power purchases with RECs from renewable generation in their grid region. A green tariff purchase enables the data center operator, the energy retailer and the grid region authority to develop experience in deploying renewable generation assets to directly power a company’s operations.

This approach is arguably more valuable and responsible than buying renewably generated power under a virtual power purchase agreement (VPPA), where there is no connection between energy generation and consumption. In the case of a VPPA, the dispatch of the generation into the market can increase price volatility and has the potential to destabilize grid reliability over time. This has been demonstrated by recent market events in Germany and in the CAISO (California Independent System Operator), ERCOT (Electric Reliability Council of Texas) and SPP (Southwest Power Pool) grid regions in the US.

Green tariffs encourage the addition of more renewable power in the grid region. Requests for green tariff contracts send a signal to the energy market that data center operators desire more renewable energy procurement options for their consumed power — which they then respond to. This is demonstrated by the increase in these offerings in many electricity markets over the past five years.

Uptime Institute believes that a green tariff contract offers many data center operators a business-friendly solution for the procurement of renewably generated electricity. But like PPAs, green tariff electricity contracts are complex vehicles. Data center operators need to develop a basic understanding of the market to fully appreciate the many nuances of the issues that must be settled to finalize a contract. It may be advisable to work with a third party with trading and market experience to identify and minimize any price and supply risks in the contract.

UI @ 2021

UI @ 2021 UI @ 2021

UI @ 2021

2020

2020

UI 2020

UI 2020