Pay-as-you-go model spreads to critical components

As enterprises continue to move from a focus on capital expenditures to operating expenditures, more data center components will also be consumed on a pay-as-you-go, “as a service” basis.

“-aaS” goes mainstream

The trend toward everything “as a service” (XaaS) is now mainstream in IT, ranging from cloud (infrastructure-aaS) and software-aaS (SaaS) to newer offerings, such as bare metal-aaS, container-aaS, and artificial intelligence-aaS (AI-aaS). At the IT level, service providers are winning over more clients to the service-based approach by reducing capital expenditures (capex) in favor of operational expenditures (opex), by offering better products, and by investing heavily to improve security and compliance. More organizations are now willing to trust them.

But this change is not confined to the IT: a similar trend is underway in data centers.

Why buy and not build?

While the cost to build new data centers is generally falling, driven partly by the availability of more prefabricated components, enterprise operators have been increasingly competing against lower-cost options to host their IT — notably colocation, cloud and SaaS.

Cost is rarely the biggest motivation for moving to cloud, but it is a factor. Large cloud providers continue to build and operate data centers at scale and enjoy the proportional cost savings as well the fruits of intense value engineering. They also spread costs among customers and tend to have much higher utilization rates compared with other data centers. And, of course, they invest in innovative, leading-edge IT tools that can be rolled out almost instantly. This all adds up to ever-improving IT and infrastructure services from cloud providers that are cheaper (and often better) than using or developing equivalent services based in a smaller-scale enterprise data center.

Many organizations have now come to view data center ownership as a big capital risk — one that only some want to take. Even when it’s cheaper to deliver IT from their own “on-premises” data center, the risks of data center early obsolescence, under-utilization, technical noncompliance or unexpected technological or local problems are all factors. And, of course, most businesses want to avoid a big capital outlay: Our research shows that, in 2017, the total cost of ownership of an “average” concurrently maintainable 3 megawatt (MW) enterprise data center amortized over 15 years was about $90 million, and that roughly half of the cost is invested in three installments over the first six years, assuming a typical phased build and bricks-and-mortar construction.

This represents a significant amount of risk. To be economically viable, the enterprise must typically operate a facility at a high level of utilization — yet forecasting future data center capacity remains enterprises’ top challenge, according to our research.

Demand for enterprise data centers remains sizable, in spite of the alternatives. Many enterprises with smaller data centers are closing them and consolidating into premium, often larger, centralized data centers and outsourcing as much else as possible.

The appeal of the cloud will continue to convince executives and drive strategy. Increasingly, public cloud is an alternative way to deliver workloads faster and cheaper without having to build additional on-premise capacity. Scalability, portability, reduced risk, better tools, high levels of resiliency, infrastructure avoidance and fewer staff requirements are other key drivers for cloud adoption. Innovation and access to leading-edge IT will likely be bigger factors in the future, as will more cloud-first remits from upper management.

Colocation, including sale leasebacks

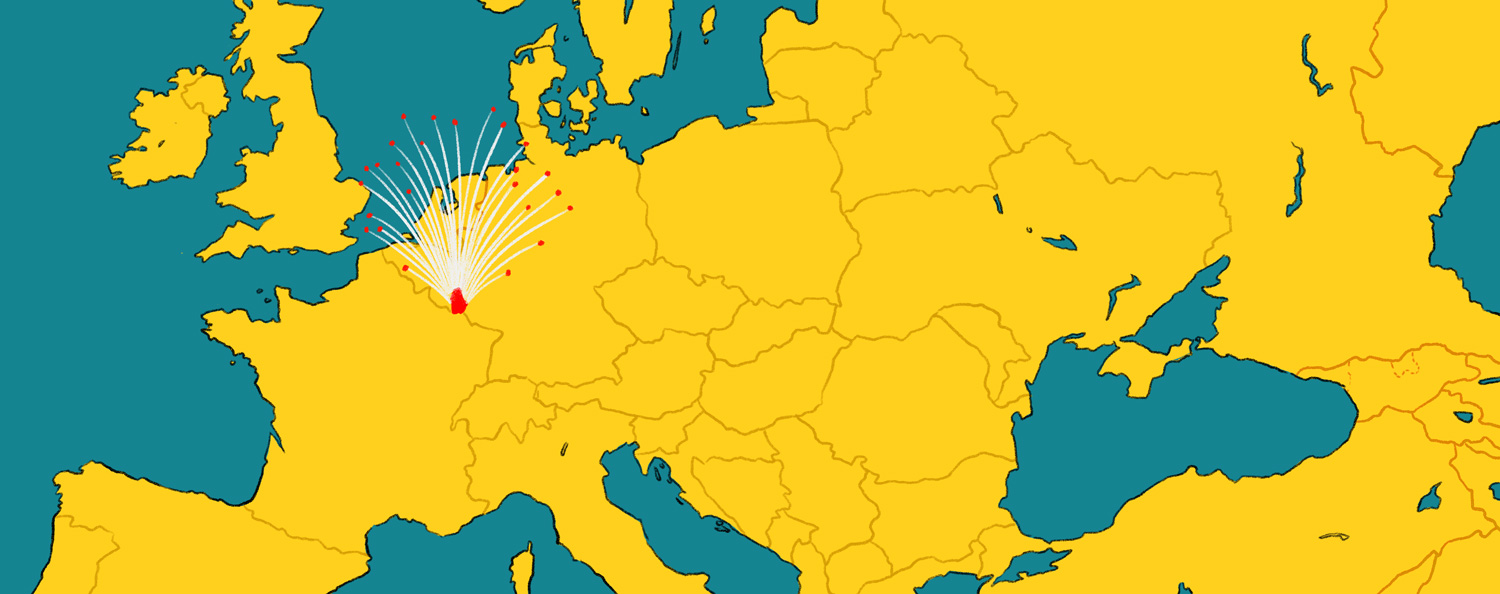

Although rarely thought of in this way, colocation is the most widely used “data center-aaS” offering today. Sale with leaseback of the data center by enterprise to colos is also becoming more common, a trend that will continue to build (see UII Note 38: Capital inflow boosts the data center market).

Colo interconnection services will attract even more businesses. More will likely seek to lease space in the same facility as their cloud or other third-party service provider, enabling lower latency and fewer costs and more security for third-party services, such as storage-aaS and disaster recovery-aaS.

While more enterprise IT is moving to colos and managed services (whether or not it is cloud), enterprise data centers will not disappear. More than 600 IT and data center managers told Uptime Institute that, in 2021, about half of all workloads will still be in enterprise data centers, and only 18% of workloads in public cloud/SaaS.

Other “as a service” trends in data centers

Data center monitoring and analysis is another relatively new example of a pay-as-you-go service. Introduced in late 2016, data center management as a service is a big data-driven cloud service that provides customized analysis and is paid for on a recurring basis. The move to a pay-as-you-go service has helped unlock the data center infrastructure management market, which was struggling for growth because of costs and complexity.

Energy backup and generation is another area to watch. Suppliers have introduced various pay-as-you-go models for their equipment. These include leased fuel cells owned by the supplier (notably Bloom Energy), which charges customers only for the energy produced. By eliminating the client’s risk and capital outlay, it can make the supplier’s sale easier (although they have to wait to be paid). Some suppliers have ventured in UPS-aaS, but with limited success to date.

More alternatives to ownership are likely for data center electrical assets, such as batteries. Given the high and fast rate of innovation in the technology, leasing large-scale battery installations delivers the capacity and innovation benefits without the risks.

It’s also likely that more large data centers will use energy service companies (ESCOs) to produce, manage and deliver energy from renewable microgrids. Demand for green energy, for energy security (that is, energy produced off-grid) and energy-price stability is growing; ESCOs can deliver all this for dedicated customers that sign long-term energy-purchase agreements but don’t have the capital required to build or the expertise necessary to run a green microgrid.

Demand for enterprise data centers will continue but alongside the use of more cloud and more colo. More will be consumed “as a service,” ranging from data center monitoring to renewable energy from nearby dedicated microgrids.

The full report Ten data center industry trends in 2020 is available to members of the Uptime Institute Network. Membership information can be found here.

2020

2020

2020

2020 2020

2020