Colocation and public cloud growth masks enterprise expansion

The colocation and public cloud sectors of the digital infrastructure industry continue to make headlines, with many organizations planning large-scale capacity expansion to meet rising demand. However, there is also a less public expansion underway — enterprises operators, for the third successive year, say they are going to invest in more data center capacity in 2024.

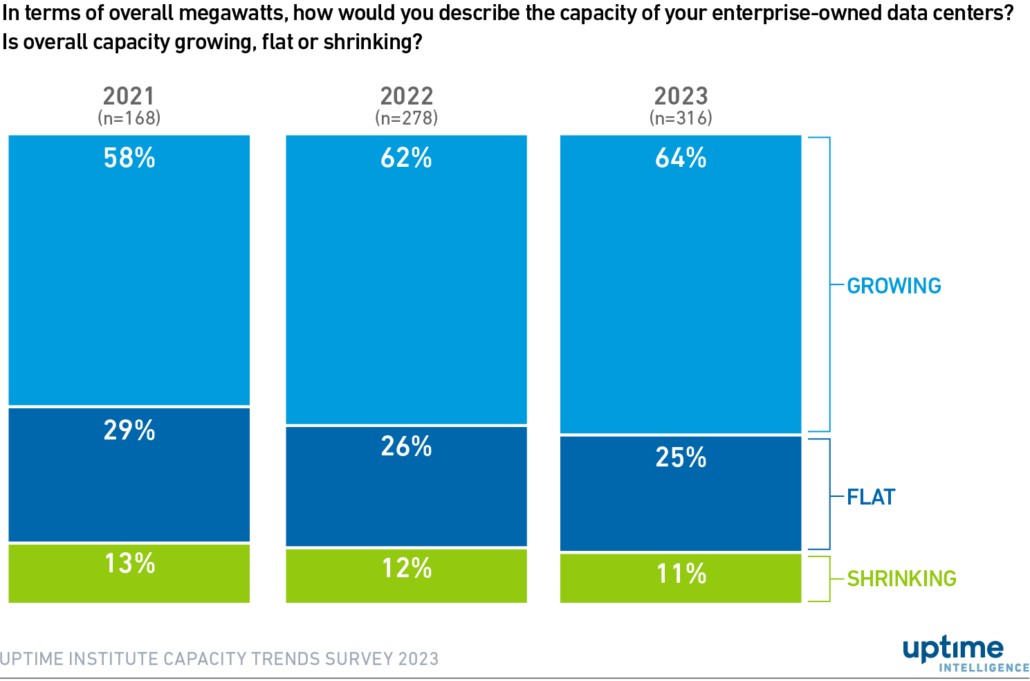

Results from the Uptime Institute Capacity Trends Survey 2023 reveal that 64% of enterprise operators are growing their data center capacity — a six percentage-point uptick from two years earlier in 2021 (see Figure 1). Notably, one in five organizations in this group say they are expanding by more than 20% annually. This scale of expansion is difficult to implement without significant investment.

Figure 1. Enterprise data center capacity shows strong growth

Some suppliers — and some operators — may be surprised by this rate of growth since it follows a decade-long period in which enterprise data centers were often dismissed as expensive, inflexible and outdated by many executives. However, Uptime’s data, which has been consistent over the past three years and is backed by many conversations, suggests that enterprise investment is strong.

What is driving this growth in enterprise data center capacity? Partly, it is simply a demand for more digital services. However, companies also say that they are investing to enhance the resiliency of their data centers (45% of survey respondents) and to support a hybrid cloud strategy (37%). Moving to cloud architectures often requires an increase in data center capacity, especially if an organization is developing distributed resiliency architectures.

Cost may also be a factor that is driving enterprise investment. According to separate Uptime research, of those enterprise operators that compared the cost of provisioning workloads on-premises versus off-premises, most report that corporate data centers are less expensive than using colocation (56%, n=154) or public cloud (51%, n=151). This is particularly true for enterprises that have already made significant investments to expand capacity.

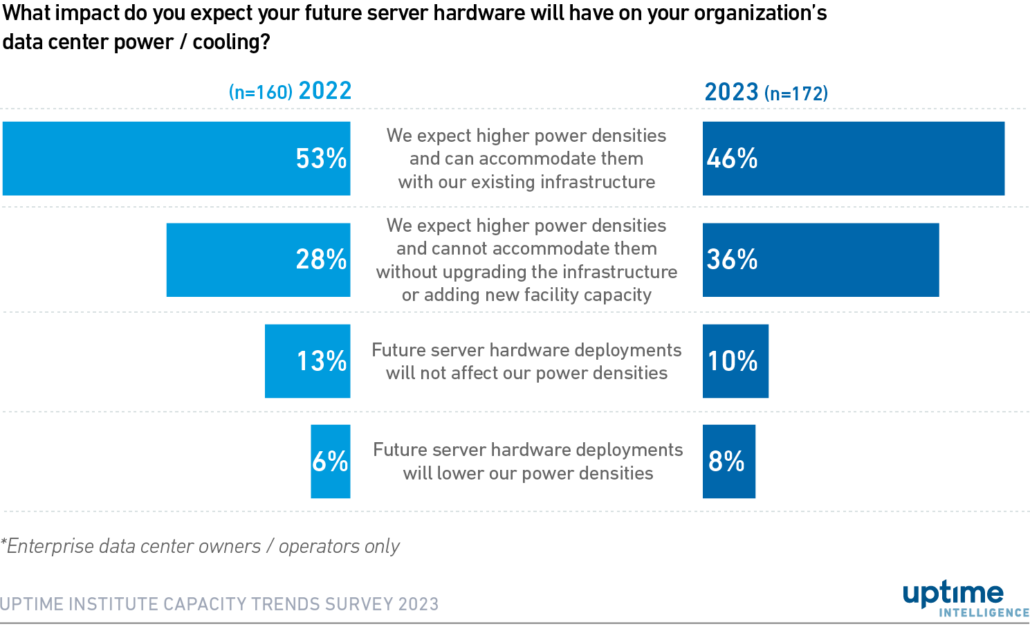

One looming problem for enterprises — and indeed for colocation companies — is the widely forecast increase in rack power density in the coming years. To accommodate this, new investments in cooling and power distribution will be required.

Four-fifths (82%) of enterprises say that they are expecting more demand for higher power densities in the next two to three years, but more than one-third (36%) say that they cannot accommodate this demand with their existing infrastructure (see Figure 2). As a result, many workloads with higher density demands will, as Uptime expects, be outsourced to third parties that have the requisite power and cooling infrastructure.

Figure 2. Many need new investment to meet expected power densities

In spite of the increased enterprise sector spending, the trend towards greater outsourcing to colocation and cloud companies is expected to remain strong (see The majority of enterprise IT is now off-premises). For example, colocation companies report more growth than their enterprise counterparts by 15 percentage points (79%, n=130), with twice as many reporting annual growth rates of more than 20% (40%, n=130).

Taken together, Uptime’s survey data shows that chief information officers are investing in cloud, hosting, colocation and enterprise data centers. While more workloads may be outsourced, the enterprise data center will most likely continue to grow and evolve. Large companies with complex mission-critical workloads, especially those that are heavily regulated, will most likely maintain on-premises sites.

However, as colocation and public cloud providers expand the depth of their services in response to the industry’s staffing, regulatory and supply chain challenges, enterprises will increasingly integrate these resources over the next decade.

The Uptime Intelligence View

Enterprise data centers have been characterized as being in decline over the past five years, especially in the context of the significant, double-digit annual growth of large colocation and public cloud organizations. But Uptime survey data has consistently shown investment in the sector. Although owning and operating data centers may not feature in the strategies employed by many large and especially newer organizations, enterprise facilities will likely remain essential to businesses beyond the medium term.

Ui 2021

Ui 2021

2020

2020