The majority of enterprise IT is now off-premises

Corporate data centers have been the backbone of enterprise IT since the 1960s and continue to play an essential role in supporting critical business and financial functions for much of the global economy. Yet, while their importance remains, their prominence as part of an enterprise’s digital infrastructure appears to be fading.

Today, businesses have more options for where to house their IT workloads than ever before. Colocation, edge sites, the public cloud infrastructure and software as a service all offer a mature alternative to take on many, if not all, enterprise workloads.

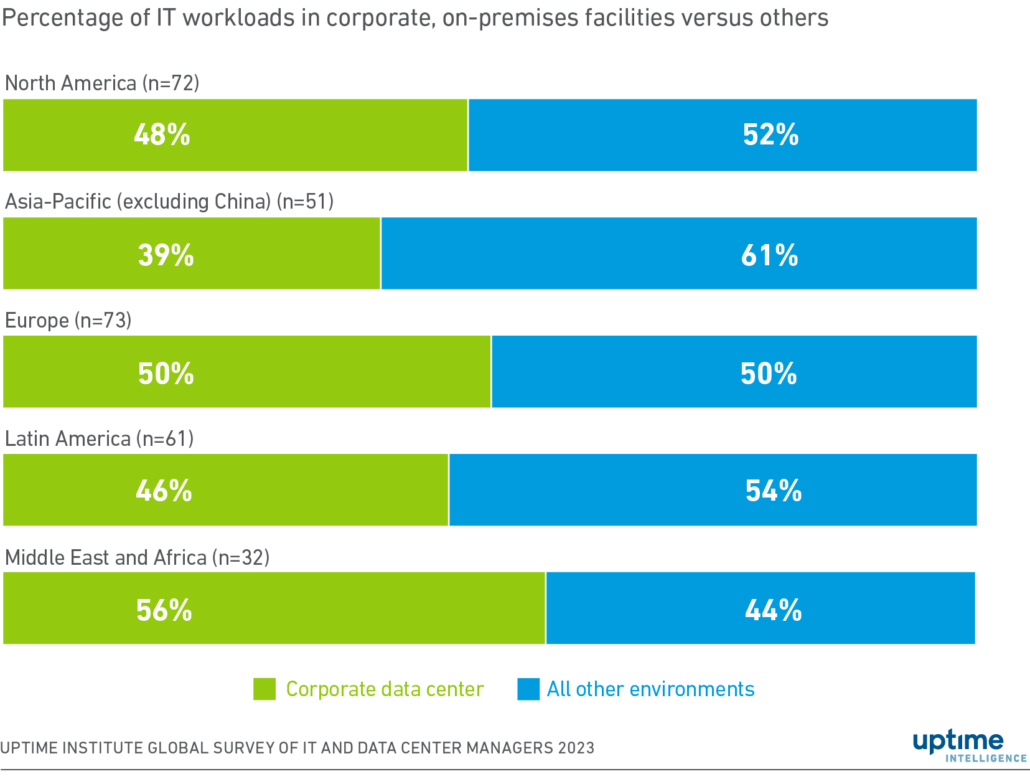

Findings from the 2023 Uptime Institute Global Data Center Survey, the longest-running survey of its kind, show for the first time that the proportion of IT workloads hosted in on-premises data centers now represents slightly less than half of the total enterprise footprint. This marks an important and long-anticipated moment for the industry.

It does not mean that corporate data center capacity, usage or expenditure is shrinking in absolute terms, but it does indicate that for new workloads, organizations are tending to choose third-party data centers and services.

The share of workloads in corporate facilities is likely to continue to fall, with organizations switching to third-party venues as the preferred deployment model for their applications — each with their own set of advantages and drawbacks but all delivering capacity without any capital expenditure.

Senior management loves outsourcing

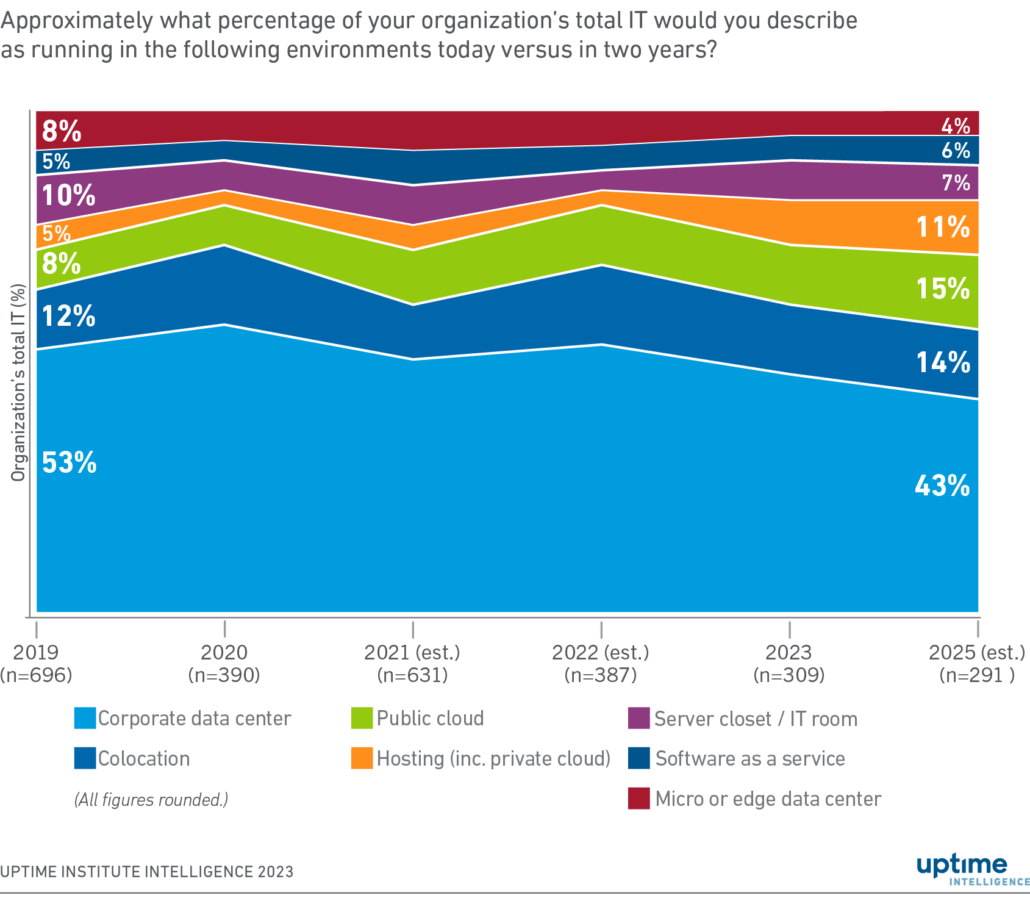

In Uptime’s 2020 annual data center survey, respondents reported that, on average, 58% of their organization’s IT workloads were hosted in corporate data centers. In 2023, this percentage fell to 48%, with respondents forecasting that just 43% of workloads would be hosted in corporate data centers in 2025 (see Figure 1).

Figure 1. Cloud and hosting grow at the expense of corporate data centers

Increasingly, the economic odds are stacked against corporate facilities as businesses look to offload the financial burden and organizational complexity of building and managing data center capacity.

Specialized third-party data centers are typically more efficient than their on-premises counterparts. Larger cloud and colocation facilities benefit from economies of scale when purchasing mechanical and electrical equipment, helping them to achieve lower costs. For some applications, smaller third-party facilities are more attractive because they enable organizations to bring latency-sensitive or high-availability services closer to industrial or commercial sites.

Data center outsourcing has several other key benefits:

- Capacity and change management. Outsourcing liberates corporate teams from the onerous task of finding the space and power required to expand their IT estates.

- Staffing and skills. The data center industry is suffering from an acute shortage of staff. When outsourcing, this becomes someone else’s problem.

- Environmental reporting. Outsourcing simplifies the process of compliance with current and upcoming sustainability regulations because it places much of the burden on the service provider.

- Supporting new (or exotic) technologies. Outsourcing enables businesses to experiment with cutting-edge IT hardware without having to make large upfront investments (e.g., dense IT clusters that require liquid cooling).

Additional regulatory requirements that will come into force in the next two to three years — such as the EU’s Energy Efficiency Directive recast (see The EU’s Energy Efficiency Directive: ready or not here it comes) — will make data center outsourcing even more tempting.

The public cloud offers a further set of advantages over in-house data centers. These include a wide selection of hardware “instances” and the ability for customers to grow or shrink their actively used IT resources at will with no advance notification. In addition to flexible pay-as-you-go pricing models, customers can tweak their costs by opting for either on-demand, reserved or spot instances. It is no surprise that the public cloud accounts for a growing proportion of IT workloads today, with a share of 12%, up from 8% in 2020.

However, this does not mean that the public cloud is a perfect fit for every workload, particularly if the application is not rearchitected to take advantage of the technical and economic benefits provided by a cloud platform. One problem highlighted by Uptime Institute Intelligence is the lack of visibility into cloud providers’ platforms, which prevents customers from assessing their operational resiliency or gaining a better understanding of potential vulnerabilities. There is also the tendency for public cloud deployments to generate runaway costs. The intense competition between cloud providers and their proprietary software stacks makes multi-cloud strategies, which alleviate some of the inherent risks in cloud architectures, too costly and complex to implement.

In specific cases, cloud service providers enjoy an oligopolistic advantage in accessing the latest technologies. For example, Microsoft, Baidu, Google and Tencent recently spent billions of dollars securing very large numbers of GPUs to build out specialized artificial intelligence (AI) training clusters, depleting the supply chain and causing GPU shortages. In the near term, many businesses that opt to develop their own AI models will simply not be able to purchase the GPUs they need and will be forced to rent them from cloud providers.

In terms of regional differences, Asia-Pacific (excluding China) is leading the shift off-premises, with just 39% of IT workloads currently hosted in corporate data centers (see Figure 2). Historically, enterprise data centers have been more developed in North America and Europe, and this category of facilities may never develop to the same extent elsewhere.

Figure 2. The regions with fewer IT workloads in corporate data centers

Digital infrastructure ecosystems in Asia and Latin America are likely to emerge as examples of “leapfrogging” — when regions with poorly developed technology bases advance directly towards the adoption of modern systems without going through intermediary steps.

The Uptime Intelligence View

In theory, the gradual movement of workloads away from in-house data centers gives colocation, cloud, and hosting providers more leverage when influencing the development of IT equipment, new mechanical and electrical designs, data center topologies, and crucially, software architectures. The constraints of enterprise data centers that have defined more than 60 years of business IT will gradually become less important. Does this mean that almost all IT workloads will — eventually — end up running in third-party data centers? This is unlikely, but it will be almost impossible for this trend to reverse: for organizations “born” in a public cloud or using colocation, moving to their own enterprise data center will tend to be highly unattractive or cost prohibitive.

2019, Getty

2019, Getty 2019

2019