Costlier new cloud generations increase lock-in risk

Cloud providers tend to adopt the latest server technologies early, often many months ahead of enterprise buyers, to stay competitive. Providers regularly launch new generations of virtual machines with identical quantities of resources (such as core counts, memory capacity, network and storage bandwidths) as the previous generation but powered by the latest technology.

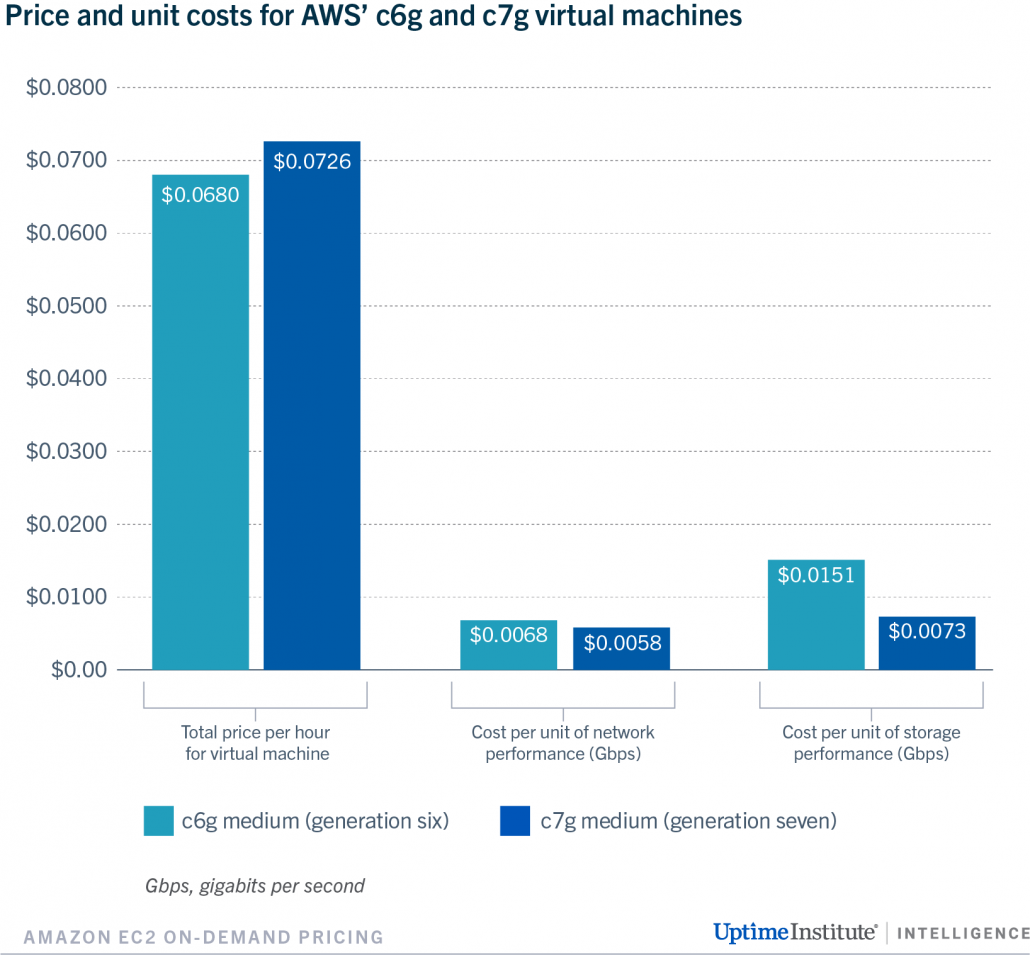

Usually, the newer generations of virtual machines are also cheaper, incentivizing users to move to server platforms that are more cost-efficient for the cloud provider. Amazon Web Services’ (AWS’) latest Graviton-based virtual machines buck that trend by being priced higher than the previous generation. New generation seven (c7g) virtual machines, based on AWS’ own ARM-based Graviton3 chips, come at a premium of around 7% compared with the last c6g generation.

A new generation doesn’t replace an older version; the older generation is still available to purchase. The user can migrate their workloads to the newer generation if they wish, but it is their responsibility to do so.

Cloud operators create significant price incentives so that users gravitate towards newer generations (and, increasingly, between server architectures). In turn, cloud providers reap the benefits of improved energy efficiency and lower cost of compute. Newer technology will also be supportable by the cloud provider for longer, compared with technology that is already close to its end of life.

AWS’ higher price isn’t unreasonable, considering Graviton3 offers higher per core performance and is built on TSMC’s (Taiwan Semiconductor Manufacturing Company, the world’s largest semiconductor foundry) bleeding edge 5 nanometer wafers, which carry a premium. The virtual machines also come with DDR5 memory, which has 1.5 times the bandwidth of the DDR4 memory used in the sixth generation equivalent but cost slightly more. With more network and storage backend bandwidth as well, AWS claims performance improvements of around 25% over the previous generation.

Supply chain difficulties, rising energy costs and political issues are raising data center costs, so AWS may not have the margin to cut prices from the previous generation to the latest. However, this complicates the business case for AWS customers, who are used to both lower prices and better performance from a new generation. With the new c7g launch, better performance alone is the selling point. Quantifying this performance gain can be challenging because it strongly depends on the application, but Figure 1 shows how two characteristics — network and storage performance — are decreasing in cost per unit due to improved capability (based on “medium”-sized virtual machine). This additional value isn’t reflected in the overall price increase of the virtual machine from generation six to seven.

A 7% increase in price seems fair if it does drive a performance improvement of 25%, as AWS claims — even if the application gains only half of that, price-performance improves.

Because more performance costs more money, the user must justify why paying more will benefit the business. For example, will it create more revenue, allow consolidation of more of the IT estate or aid productivity? These impacts are not so easy to quantify. For many applications, the performance improvements on the underlying infrastructure won’t necessarily translate to valuable application performance gains. If the application already delivers on quality-of-service requirements, more performance might not drive more business value.

Using Arm’s 64-bit instruction set, Graviton-based virtual machines aren’t as universal in their software stack as those based on x86 processors. Most of the select applications built for AWS’ Graviton-based range would have been architected and explicitly optimized to run best on AWS and Graviton systems for better price-performance. As a result, most existing users will probably migrate to the newer c7g virtual machine to gain further performance improvements, albeit more slowly than if it was cheaper.

Brand new applications will likely be built for the latest generation, even if more expensive than before. We expect AWS to reduce the price of c7g Graviton-based virtual machines as its rollout ramps up, input costs gradually become less and sixth generation systems become increasingly out-of-date and costlier to maintain.

It will be interesting to see if this pattern repeats with x86 virtual machines, complicating the business case for migration. With next-generation platforms from both Intel and AMD launching soon, the next six to 12 months will confirm whether generational price increases form a trend, even if only transitionary.

Any price hikes could create challenges down the line. If a generation becomes outdated and difficult to maintain, will cloud providers then force users to migrate to newer virtual machines? If they do and the cost is higher, will buyers – now invested and reliant on the cloud provider — be forced to pay more or will they move elsewhere? Or will cloud providers increase prices of older, legacy generations to continue support for those willing to pay, just as many software vendors charge enterprise support costs? Moving to another cloud provider isn’t trivial. A lack of standards and commonality in cloud provider services and application programming interfaces mean cloud migration can be a complex and expensive task, with its own set of business risks. Being locked-in to a cloud provider isn’t really a problem if the quality of service remains acceptable and prices remain flat or reduce. But if users are being asked to pay more, they may be stuck between a rock and a hard place — pay more to move to the new generation or pay more to move to a different cloud provider.

2019

2019 2020

2020

2020

2020