DCIM past and present: what’s changed?

Data center infrastructure management (DCIM) software is an important class of software that, despite some false starts, many operators regard as essential to running modern, flexible and efficient data centers. It has had a difficult history — many suppliers have struggled to meet customer requirements and adoption remains patchy. Critics argue that, because of the complexity of data center operations, DCIM software often requires expensive customization and feature development for which many operators have neither the expertise nor the budget.

This is the first of a series of reports by Uptime Intelligence exploring data center management software in 2024 — two decades or more after the first commercial products were introduced. Data center management software is a wider category than DCIM: many products are point solutions; some extend beyond a single site and others have control functions. Uptime Intelligence is referring to this category as data center management and control (DCM-C) software.

DCIM, however, remains at the core. This report identifies the key areas in which DCIM has changed over the past decade and, in future reports, Uptime Intelligence will explore the broader DCM-C software landscape.

What is DCIM?

DCIM refers to data center infrastructure management software, which collects and manages information about a data center’s IT and facility assets, resource use and operational status, often across multiple systems and distributed environments. DCIM primarily focuses on three areas:

- IT asset management. This involves logging and tracking of assets in a single searchable database. This can include server and rack data, IP addresses, network ports, serial numbers, parts and operating systems.

- Monitoring. This usually includes monitoring rack space, data and power (including power use by IT and connected devices), as well as environmental data (such as temperature, humidity, air flow, water and air pressure).

- Dashboards and reporting. To track energy use, sustainability data, PUE and environmental health (thermal, pressure etc.), and monitor system performance, alerts and critical events. This may also include the ability to simulate and project forward – for example, for the purposes of capacity management.

In the past, some operators have taken the view that DCIM does not justify the investment, given its cost and the difficulty of successful implementation. However, these reservations may be product specific and can depend on the situation; many others have claimed a strong return on investment and better overall management of the data center with DCIM.

Growing need for DCIM

Uptime’s discussions with operators suggest there is a growing need for DCIM software, and related software tools, to help resolve some of the urgent operational issues around sustainability, resiliency and capacity management. The current potential benefits of DCIM include:

- Improved facility efficiency and resiliency through automating IT updates and maintenance schedules, and the identification of inefficient or faulty hardware.

- Improved capacity management by tracking power, space and cooling usage, and locating appropriate resources to reserve.

- Procedures and rules are followed. Changes are documented systematically; asset changes are captured and stored — and permitted only if the requirements are met.

- Denser IT accommodated by identifying available space and power for IT, it may be easier to densify racks, such as allocate resources to AI/machine learning and high-performance computing. The introduction of direct liquid cooling (DLC) will further complicate environments.

- Human error eliminated through a higher degree of task automation, as well as improved workflows, when making system changes or updating records.

Meanwhile, there will be new requirements from customers for improved monitoring, reporting and measurement of data, including:

- Monitoring equipment performance to avoid undue wear and tear or system stress might reduce the risk of outages.

- Shorter ride through times may require more monitoring. For example, IT equipment may only have a short window of cooling from the UPS, in the event of a major power outage.

- Greater variety of IT equipment (graphics processing units, central processing units, application-specific integrated circuits) may mean a less predictable, more unstable environment. Monitoring will be required to ensure that their different power loads, temperature ranges and cooling requirements are managed effectively.

- Sustainability metrics (such as PUE), as well as other measurables (such as water usage effectiveness, carbon usage effectiveness and metrics to calculate Scope 1, 2 or 3 greenhouse gas emissions).

- Legal requirements for transparency of environmental, sustainability and resiliency data.

Supplier landscape resets

In the past decade, many DCIM suppliers have reset, adapted and modernized their technology to meet customer demand. Many have now introduced mobile and browser-based offerings, colocation customer portals and better metrics tracking, data analytics, cloud and software as a service (SaaS).

Customers are also demanding more vendor agnostic DCIM software. Operators have sometimes struggled with DCIM’s inability to work with existing building management systems from other vendors, which then requires additional costly work on application programming interfaces and integration. Some operators have noted that DCIM software from one specific vendor still only provides out-of-the-box monitoring for their own brand of equipment. These concerns have influenced (and continue to influence) customer buying decisions.

Adaptation has been difficult for some of the largest DCIM suppliers, and some organizations have now exited the market. As one of the largest data center equipment vendors, for example, Vertiv’s discontinuation of Trellis in 2021 was a significant exit: customers found Trellis too large and complex for most implementations. Even today, operators continue to migrate off Trellis onto other DCIM systems.

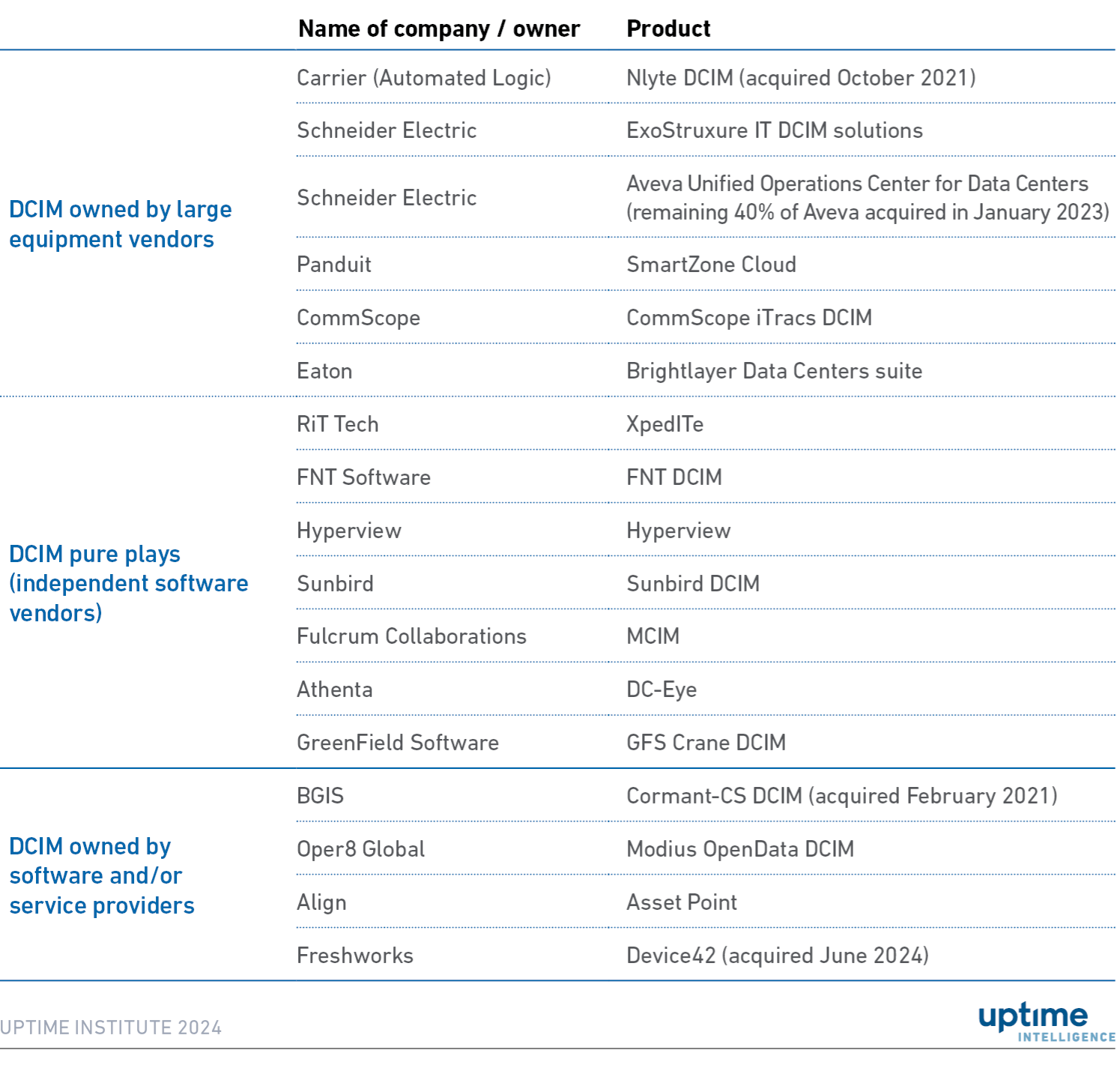

Other structural change in the DCIM market include Carrier and Schneider Electric acquiring Nlyte and Aveva, respectively, and Sunbird spinning out from hardware vendor Raritan (Legrand) (see Table 1).

Table 1. A selection of current DCIM suppliers

There are currently a growing number of independent service vendors currently offering DCIM, each with different specialisms. For example, Hyperview is solely cloud-based, RiT Tech focuses on universal data integration, while Device42 specialises in IT asset discovery. Independent service vendors benefit those unwilling to acquire DCIM software and data center equipment from the same supplier.

Those DCIM software businesses that have been acquired by equipment vendors are typically kept at arm’s length. Schneider and Carrier both retain the Aveva and Nlyte brands and culture to preserve their differentiation and independence.

There are many products in the data center management area that are sometimes — in Uptime’s view —labeled incorrectly as DCIM. These include products that offer discrete or adjacent DCIM capabilities, such as: Vertiv Environet Alert (facility monitoring); IBM Maximo (asset management); AMI Data Center Manager (server monitoring); Vigilent (AI-based cooling monitoring and control); and EkkoSense (digital twin-based cooling optimization). Uptime views these as part of the wider DCM-C control category, which will be discussed in a future report in this series.

Attendees at Uptime network member events between 2013 and 2020 may recall that complaints about DCIM products, implementation, integration and pricing were a regular feature. Much of the early software was market driven, fragile and suffered from performance issues, but DCIM software has undoubtedly improved from where it was a decade ago.

The next sections of this report discuss areas in which DCIM software has improved and where there is still room for improvement.

Modern development techniques

Modern development techniques, such as continuous improvement / continuous delivery and agile / DevOps have encouraged a regular cadence of new releases and updates. Containerized applications have introduced modular DCIM, while SaaS has provided greater pricing and delivery flexibility.

Modularity

DCIM is no longer a monolithic software package. Previously, it was purchased as a core bundle, but now DCIM is more modular with add-ons that can be purchased as required. This may make DCIM more cost-effective, with operators being able to more accurately assess the return on investment, before committing to further investment. Ten years ago, the main customers for DCIM were enterprises, with control over IT — but limited budgets. Now, DCIM customers are more likely to be colocation providers with more specific requirements, little interest in the IT, and probably require more modular, targeted solutions with links into their own commercial systems.

SaaS

Subscription-based pricing for greater flexibility and visibility on costs. This is different from traditional DCIM licence and support software pricing, which typically locked customers in for minimum-term contracts. Since SaaS is subscription-based, there is more onus on the supplier to respond to customer requests in a timely manner. While some DCIM vendors offer cloud-hosted versions of their products, most operators still opt for on-premises DCIM deployments, due to perceived data and security concerns.

IT and software integrations

Historically, DCIM suffered from configurability, responsiveness and integration issues. In recent years, more effort has been made toward third-party software and IT integration and encouraging better data sharing between systems. Much DCIM software now uses application programming interfaces (APIs) and industry standard protocols to achieve this:

Application programming interfaces

APIs have made it easier for DCIM to connect with third-party software, such as IT service management, IT operations management, and monitoring and observability tools, which are often used in other parts of the organization. The aim for operators is to achieve a comprehensive view across the IT and facilities landscape, and to help orchestrate requests that come in and out of the data center. Some DCIM systems, for example, come with pre-built integrations and tools, such as ServiceNow and Salesforce, that are widely used by IT enterprise teams. These enterprise tools can provide a richer set of functionalities in IT and customer management and support. They also use robotic process automation technology, to automate repetitive manual tasks, such as rekeying data between systems, updating records and automating responses.

IT/OT protocols

Support for a growing number of IT/OT protocols has made it easier for DCIM to connect with a broader range of IT/OT systems. This helps operators to access the data needed to meet new sustainability requirements. For example, support for simple network management protocol can provide DCIM with network performance data that can be used to monitor and detect connection faults. Meanwhile, support for the intelligent platform management interface can enable remote monitoring of servers.

User experience has improved

DCIM provides a better user experience than a decade ago. However, operators still need to be vigilant that a sophisticated front end is not a substitute for functionality.

Visualization

Visualization for monitoring and planning has seen significant progress, with interactive 3D and augmented reality views of IT equipment, racks and data halls.Sensor data is being used, for example, to identify available capacity, hot-spots or areas experiencing over-cooling. This information is presented visually to the user, who can follow changes over time and drag and drop assets into new configurations. On the fringes of DCIM, computational fluid dynamics can visualize air flows within the facility, which can then be used to make assumptions about the impact of specific changes on the environment. Meanwhile, the increasing adoption of computer-aided design can enable operators to render accurate and dynamic digital twin simulations for data center design and engineering and, ultimately, the management of assets across their life cycle.

Better workflow automation

At a process level, some DCIM suites offer workflow management modules to help managers initiate, manage and track service requests and changes. Drag and drop workflows can help managers optimize existing processes. This has the potential to reduce data entry omissions and errors, which have always been among the main barriers to successful DCIM deployments.

Rising demand for data and AI

Growing demand for more detailed data center metrics and insights related to performance, efficiency and regulations will make DCIM data more valuable. This, however, depends on how well DCIM software can capture, store and retrieve reliable data across the facility.

Customers today require greater levels of analytical intelligence from their DCIM. Greater use of AI and ML could enable the software to spot patterns, anomalies and provide next best action recommendations. DCIM has not fared well in this area, which has opened the door to a new generation of AI-enabled optimization tools. The Uptime report What is the role of AI in digital infrastructure management? identifies three near-term applications of ML in the data center — predictive analytics, equipment setting optimization and anomaly detection.

DCIM is making progress in sustainability data monitoring and reporting and a number of DCIM suppliers are now actively developing sustainability modules and dashboards. One supplier, for example, is developing a Scope 1, 2 and 3 greenhouse gas emissions model based on a range of datasets, such as server product performance sheets, component catalogs and the international Environmental Product Declaration (EPD) database. Several suppliers are working on dashboards that bring together all the data required for compliance with the EU’s Energy Efficiency Directive. Once functional, these dashboards could compare data centers, devices and manufacturers, as well as provide progress reports.

The Uptime Intelligence View

DCIM has matured as a software solution over the past decade. Improvements in function modularity, SaaS, remote working, integration, user experience and data analytics, have all progressed to the point where DCIM is now considered a viable and worthwhile investment. DCIM data will also be increasingly valuable for regulatory reporting requirements. Nonetheless, there remains more work to be done. Customers still have legitimate concerns about its complexity, cost and accuracy, while DCIM’s ability to apply AI and analytics — although an area of great promise — is still viewed cautiously. Even when commercial DCIM packages were less robust and functional, those operators that researched it diligently and deployed it carefully found it to be largely effective. This remains true today.