Data centers without diesel generators: The groundwork is being laid…

In 2012, Microsoft announced that it planned to eliminate engine generators at its big data center campus in Quincey, Oregon. Six years later the same group, with much the same aspirations, filed for permission to install 72 diesel generators, which have an expected life of at least a decade. This example illustrates clearly just how essential engine generators are to the operation of medium and large data centers. Few — very few — can even contemplate operating production environments without diesel generators.

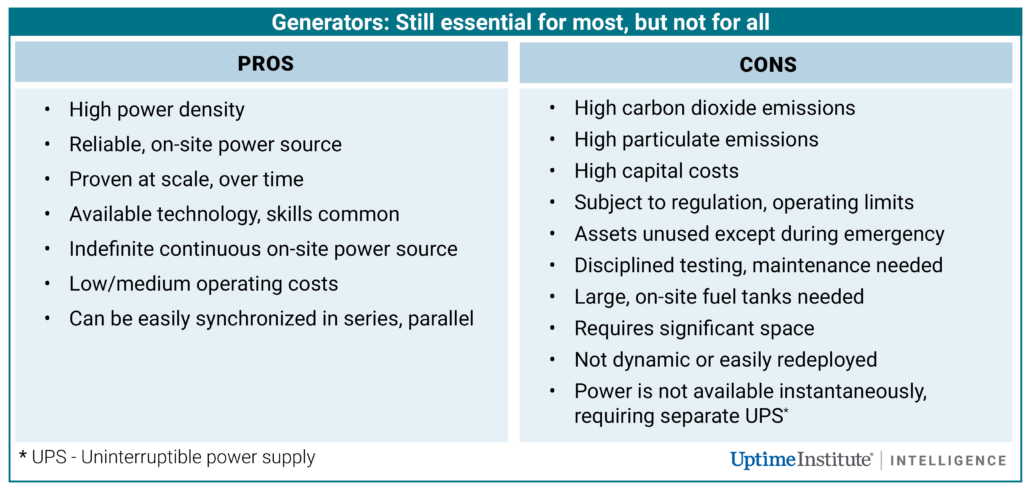

Almost every operator and owner would like to eliminate generators and replace them with a more modern, cleaner technology. Diesel generators are dirty — they emit both carbon dioxide and particulates, which means regulation and operating restrictions; they are expensive to buy; they are idle most of the time; and they have an operational overhead in terms of testing, regulatory conformity and fuel management (i.e., quality, supply and storage logistics).

But to date, no other technology so effectively combines low operating costs, energy density, reliability, local control and, as long as fuel can be delivered, open-ended continuous power.

Is this about to change? Not wholly, immediately or dramatically — but yes, significantly. The motivation to eliminate generators is becoming ever stronger, especially at the largest operators (most have eliminated reportable carbon emissions from their grid supply, leaving generators to account for most of the rest). And the combination of newer technologies, such as fuel cells, lithium-ion (Li-ion) batteries and a lot of management software, is beginning to look much more effective. Even where generators are not eliminated entirely, we expect more projects from 2020 onward will involve less generator cover.

Four Areas of Activity

There are four areas of activity in terms of technology, research and deployment that could mean that in the future, in some situations, generators will play a reduced role — or no role at all.

Fuel cells and on-site continuous renewables

The opportunity for replacing generators with fuel cells has been intensively explored (and to a lesser extent, tried) for a decade. At least three suppliers — Bloom Energy (US), Doosan (South Korea) and SOLIDPower (Germany) — have some data center installations. Of these, Bloom’s success with Equinix is best known. Fuel cells are arguably the only technology, after generators, that can provide reliable, on-site, continuous power at scale.

The use of fuel cells for data centers is controversial and hotly debated. Some, including the city of Santa Clara in California, maintain that fuel cells, like generators, are not clean and green, because most use fossil fuel-based gas (or hydrogen, which usually requires fossil fuel-based energy to isolate). Others say that using grid-supplied or local storage of gas introduces risks to availability and safety.

These arguments are possibly easily overcome, given the reliability of gas and the fact that very few safety issues ever occur. But fuel cells have two other disadvantages: first, they cost more than generators on a kilowatt-hour (kWh) per dollar($) basis and have mostly proven economic only when supported by grants; and second, they require a continuous, steady load (depending on the fuel cell architecture). This causes design and cost complications.

The debate will continue but even so, fuel cells are being deployed: a planned data center campus in Connecticut (owner/operator currently confidential) will have 20 MW of Doosan fuel cells, Equinix is committing to more installations, and Uptime Institute is hearing of new plans elsewhere. The overriding reason is not cost or availability, but rather the ability to achieve a dramatic reduction in carbon dioxide and other emissions and to build architectures in which the equipment is not sitting idle.

The idea of on-site renewables as a primary source of at-scale energy has gained little traction. But Uptime Institute is seeing one trend gathering pace: the colocation of data centers with local energy sources such as hydropower (or, in theory, biogas). At least two projects are being considered in Europe. Such data centers would draw from two separate but local sources, providing a theoretical level of concurrent maintainability should one fail. Local energy storage using batteries, pumped storage and other technologies would provide additional security.

Edge data centers

Medium and large data centers have large power requirements and, in most cases, need a high level of availability. But this is not always the case with smaller data centers, perhaps below 500 kilowatt (kW), of which there are expected to be many, many more in the decade ahead. Such data centers may more easily duplicate their loads and data to similar data centers nearby, may participate in distributed recovery systems, and may, in any case, cause fewer problems if they suffer an outage.

But above all, these data centers can deploy batteries (or small fuel calls) to achieve a sufficient ride-through time while the network redeploys traffic and workloads. For example, a small shipping container-sized 500 kWh Li-ion battery could provide all uninterruptible power supply (UPS) functions, feed power back to the grid and provide several hours of power to a small data center (say, 250 kW) in the event of a grid outage. As the technology improves and prices drop, such deployments will become commonplace. Furthermore, when used alongside a small generator, these systems could provide power for extended periods.

Cloud-based resiliency

When Microsoft, Equinix and others speak of reducing their reliance on generators, they are mostly referring to the extensive use of alternative power sources. But the holy grail for the hyperscale operators, and even smaller clusters of data centers, is to use availability zones, traffic switching, replication, load management and management software to rapidly re-configure if a data center loses power.

Such architectures are proving effective to a point, but they are expensive, complex and far from fail-safe. Even with full replication, the loss of an entire data center cannot but cause performance problems. For this reason, all the major operators continue to build data centers with concurrent maintainability and on-site power at the data center level.

But as software improves and Moore’s law continues to advance, will this change? Based on the state of the art in 2019 and the plans for new builds, the answer is categorically “not yet.” But in 2019, at least one major operator conducted tests to determine its resiliency using these technologies. The likely goal would not be to eliminate generators altogether, but to reduce the portion of the workload that would need generator cover.

Li-ion and smart energy

For the data center designer, one of the most significance advances of the past several years is the maturing — technically and economically — of the Li-ion battery. From 2010 to 2018, the cost of Li-ion batteries (in $ per kWh) fell 85%, according to Bloomberg-NEF (New Energy Finance). Most analysts expect prices to continue to fall steadily for the next five years, with large-scale manufacturing being the major reason. While this is no Moore’s law, it is creating an opportunity to introduce a new form of energy storage in new ways — including the replacement of some generators.

It is early days, but major operators, manufacturers and startups alike are all looking at how they can use Li-ion storage, combined with multiple forms of energy generation, to reduce their reliance on generators. Perhaps this should not be seen as the direct replacement of generators with Li-ion storage, since this is not likely to be economic for some time, but rather the use of Li-ion storage not just as a standard UPS, but more creatively and more actively. For example, combined with load shifting and closing down applications according to their criticality, UPS ride-throughs can be dramatically extended and generators will be turned on much later (or not all). Some may even be eliminated. Trials and pilots in this area are likely to be initiated or publicized in 2020 or soon after.

(Alternative technologies that could compete with lithium-ion batteries in the data center include sodium-ion batteries based on Prussian blue electrodes.)

The full report Ten data center industry trends in 2020 is available to members of the Uptime Institute Network here.

2019

2019 Uptime Institute, 2019

Uptime Institute, 2019 2020

2020

UI 2021

UI 2021

Getty

Getty

2019

2019 2019

2019