Edge Computing – The Next Frontier

One of the most widely anticipated trends in IT and infrastructure is significant new demand for edge computing, fueled by technologies such as 5G, IoT and AI. To date, net new demand for edge computing — processing, storing and integrating data close to where it is generated — has built slowly. As a result, some suppliers of micro data center and edge technologies have had to lower their investors’ expectations.

This slow build-out, however, does not mean that it will not happen. Demand for decentralized IT will certainly grow. There will be more workloads that need low latency, such as healthcare tech, high performance computing (notably more AI), critical IoT, and virtual and augmented reality, as well as more traffic from latency-sensitive internet companies (as Amazon famously said 10 years ago, every 100 milliseconds of latency costs them one percent in sales). There will also be more data generated by users and “things” at the edge, which will be too expensive to transport across long distances to large, centralized data centers (the “core”).

For all these reasons, new edge data center and connectivity capacity will be needed, and we expect a wave of new partnerships and deals in 2021. Enterprises will connect to clouds via as-a-service (on-demand, software-driven) interconnections at the edge, and the internet will extend its reach with new exchange points. Just as the internet is a network of tens of thousands of individual networks connected together, the edge will require not just new capacity but also a new ecosystem of suppliers working together. The year 2021 will likely see intense activity — but the long-expected surge in demand may have to wait.

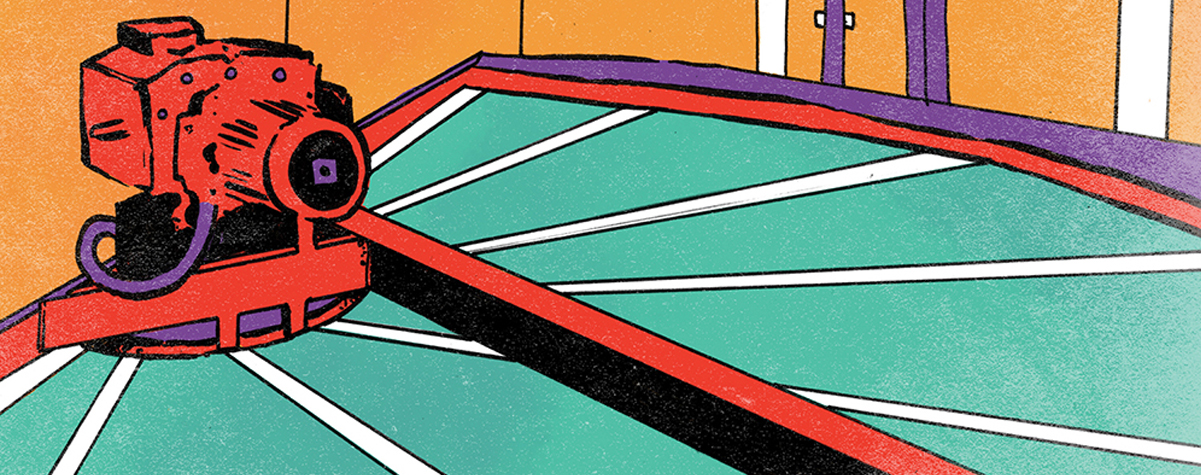

The edge build-out will be uneven, in part because the edge is not a monolith. Different edge workloads need different levels of latency, bandwidth and resiliency, as shown in the data center schema below. Requirements for data transit and exchanges will also vary. Edge infrastructure service providers will need to rely on many partners, including specialist vendors that will serve different customer requirements. Enterprise customers will become increasingly dependent on third-party connections to different services.

So far, much attention has been focused on the local edge, where connectivity and IT capacity are sited within a kilometer or so from devices and users. In urban areas, where 5G is (generally) expected to flourish, and in places where a lot of IoT data is generated, such as factories and retail stores, we are slowly seeing more micro data centers being deployed. These small facilities can act either as private connections or internet exchange points (or both), handing off wireless data to a fiber connection and creating new “middle-mile” connections.

We expect that edge micro data centers will be installed both privately and as shared infrastructure, including for cloud providers, telcos and other edge platform providers, to reduce latency and keep transit costs in check. To get closer to users and “things,” fiber providers will also partner with more wireless operators.

In 2021, most of the action is likely to be one step further back from the edge, in regional locations where telcos, cloud providers and enterprises are creating — or consuming — new interconnections in carrier-neutral data centers such as colo and wholesale facilities. All major cloud providers are increasingly creating points of presence (PoPs) in more colos, creating software-defined WANs of public (internet) and private (enterprise) connections. Colo customers are then able to connect to various destinations, depending on their business needs, via software, hardware and networks that colos are increasingly providing. These interconnections are making large leased facilities a preferred venue for other suppliers to run edge infrastructure-as-a-service offerings, including for IoT workloads. For enterprises and suppliers alike, switching will become as important as power and space.

We expect more leased data centers will be built (and bought) in cities and suburbs in 2021 and beyond. Large and small colos alike will place more PoPs in third-party facilities. And more colos will provide more software-driven interconnection platforms, either via internal development, partnerships or acquisitions.

At the same time, CDNs that already have large edge footprints will further exploit their strong position by offering more edge services on their networks directly to enterprises. We’re also seeing more colos selling “value-add” IT and infrastructure-as-a-service products — and we expect they will extend further up the IT stack with more compute and storage capabilities.

The edge build-out will clearly lead to increased operational complexity, whereby suppliers will have to manage hundreds of application program interfaces and multiple service level agreements. For these reasons, the edge will need to become increasingly software-defined and driven by AI. We expect investment and partnerships across all these areas.

How exactly it will play out remains unclear; it is simply too early. Already we have seen major telco and data center providers pivot their edge strategies, including moving from partnerships to acquisitions.

One segment we are watching particularly closely is the big internet and cloud companies. Having built significant backbone infrastructure, they have made little or only modest investments to date at the edge. With their huge workloads and deep pockets, their appetite for direct ownership of edge infrastructure is not yet known but could significantly shape the ecosystem around them.

The full report Five data center trends for 2021 is available to members of Uptime Institute, guest membership can be found here.

UI @ 2020

UI @ 2020 UI @2021

UI @2021