Energy-efficiency focus to shift to IT — at last

Data centers have become victims of their own success. Ever-larger data centers have mushroomed across the globe in line with an apparently insatiable demand for computing and storage capacity. The associated energy use is not only expensive (and generating massive carbon emissions) but is also putting pressure on the grid. Most data center developments tend to be concentrated in and around metropolitan areas — making their presence even more palpable and attracting scrutiny.

Despite major achievements in energy performance throughout the 2010s — as witnessed by Uptime data on industry-average PUE — this has created challenges for data center builders and operators. Delivering bulletproof and energy-efficient infrastructure at a competitive cost is already a difficult balancing act, even without having to engage with local government, regulators and the public at large on energy use, environmental impact and carbon footprint.

IT is conspicuously absent from this dialogue. Server and storage infrastructure account for the largest proportion of a data centers’ power consumption and physical footprint. As such, they also offer the greatest potential for energy-efficiency gains and footprint compression. Often the issue is not wasted but unused power: poor capacity-planning practices create demand for additional data center developments even where unused (but provisioned) capacity is available.

Nonetheless, despite growing costs and sustainability pressures, enterprise IT operators — as well as IT vendors — continue to show little interest in the topic.

This will be increasingly untenable in the years ahead. In the face of limited power availability in key data center markets, together with high power prices and mounting pressure to meet sustainability legislation, enterprise IT’s energy footprint will have to be addressed more seriously. This will involve efficiency-improvement measures aimed at using dramatically fewer server and storage systems for the same workload.

Uptime has identified four key areas where pressure on IT will continue to build — all of them pointing in the same direction:

- Municipal (local) resistance to new large data centers.

- The limited availability of grid power to support increasing data center capacity.

- Increasing regulation governing sustainability and carbon reduction, and more stringent reporting requirements.

- High energy costs.

Municipalities — and utility providers — need the pace to drop

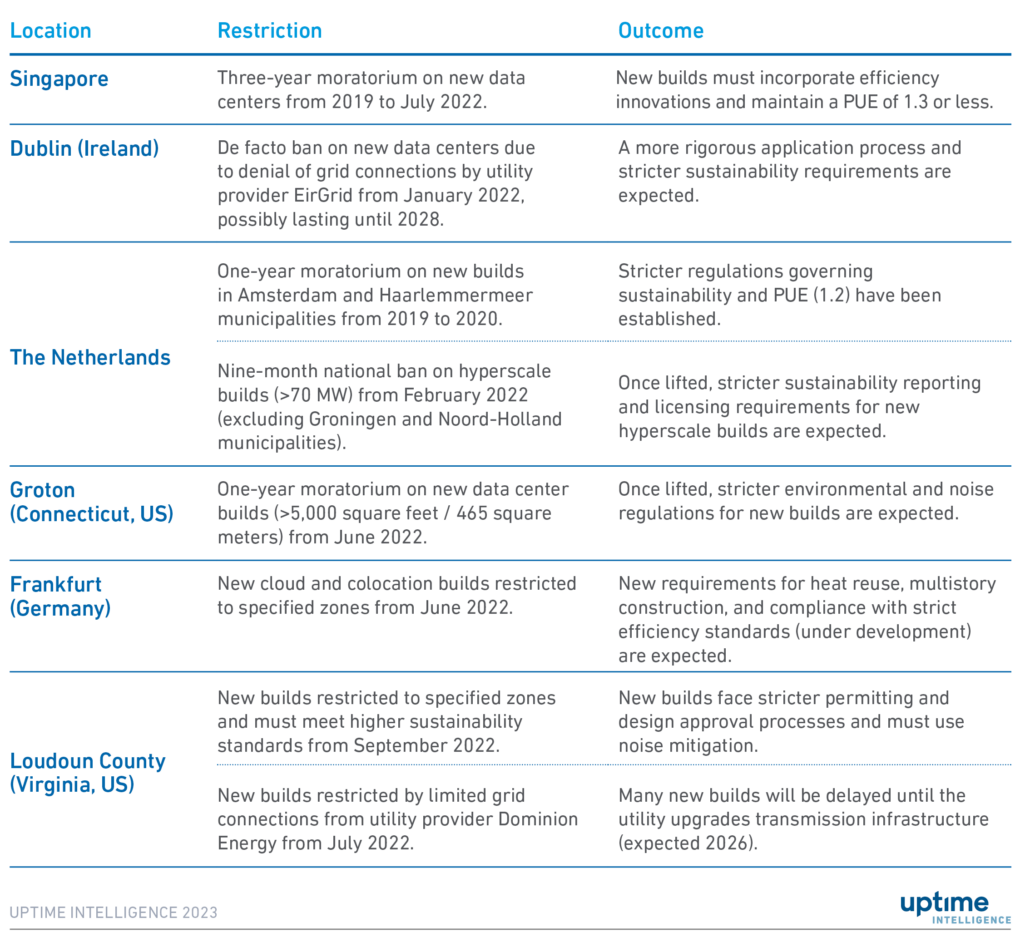

Concerns over power and land availability have, since 2019, led to greater restrictions on the construction of new data centers (Table 1). This is likely to intensify. Interventions on the part of local government and utility providers typically involve more rigorous application processes, more stringent energy-efficiency requirements and, in some cases, the outright denial of new grid connections for major developments. These restrictions have resulted in costly project delays (and, in some cases, cancellations) for major cloud and colocation providers.

Frankfurt, a key financial hub and home to one of the world’s largest internet exchange ecosystems, set an example. Under a new citywide masterplan (announced in 2022), the city stipulates densified, multistory and energy-optimized data center developments — chiefly out of concerns for sprawling land use and changes to the city’s skyline.

The Dublin area (Ireland) and Loudoun County (Northern Virginia, US) are two stand-out examples (among others) of the grid being under strain and power utilities having temporarily paused or capped new connections because of current shortfalls in generation or transmission capacity. Resolving these limitations is likely to take several years. A number of data center developers in both Dublin and Loudoun County have responded to these challenges by seeking locations further afield.

Table 1 Restrictions on new data centers since 2019 — selected examples

New sustainability regulations

Following years of discussion with key stakeholders, authorities have begun introducing regulation governing performance improvements and sustainability reporting for data centers — a key example being the EC’s Energy Efficiency Directive recast (EED), which will subject data centers directly to regulation aimed at reducing both energy consumption and carbon emissions (see Critical regulation: the EU Energy Efficiency Directive recast).

This regulation creates new, detailed reporting requirements for data centers in the EU and will force operators to improve their energy efficiency and to make their energy performance metrics publicly available — meaning investors and customers will be better equipped to weigh business decisions on the basis of the organizations’ performance. The EED is expected to enter into force in early 2023. At the time of writing (December 2022), the EED could still be amended to include higher targets for efficiency gains (increasing from 9% to 14.5%) by 2030. The EC has already passed legislation mandating regulated organizations to report on climate-related risks, their potential financial impacts and environmental footprint data every year from 2025, and will affect swathes of data centers.

Similar initiatives are now appearing in the US, with the White House Office of Technology and Science Policy’s (OTSP’s) Climate and Energy Implications of Crypto-assets in the US report, published in September 2022. Complementary legislation is being drafted that addresses both crypto and conventional data centers and sets the stage for the introduction of similar regulation to the EED over the next three to five years (see First signs of federal data center reporting mandates appear in US).

Current and draft regulation is predominantly focused on the performance of data center facility infrastructure (power and cooling systems) in curbing the greenhouse gas emissions (GHGs) associated with utility power consumption (Scope 2). While definitions and metrics remain vague (and are subject to ongoing development) it is clear that EC regulators intend to ultimately extend the scope of such regulation to also include IT efficiency.

Expensive energy is here to stay

The current energy crises in the UK, Europe and elsewhere are masking some fundamental energy trends. Energy prices and, consequently, power prices were on an upward trajectory before Russia’s invasion of Ukraine. Wholesale forward prices for electricity were already shooting up — in both the European and US markets — in 2021.

Certain long-term trends also underpin the trajectory towards costlier power and create an environment conducive to volatility. Structural elements to long-term power-price inflation include:

- The global economy’s continued dependence on (and continued increasing consumption of) oil and gas.

- Underinvestment in fossil-fuel supply capacities while alternative low-carbon generation and energy storage capacities remain in development.

- Gargantuan build-out of intermittent power generation capacity (overwhelmingly wind and solar) as opposed to firm low-carbon generation.

- Steady growth in power demand arising from economic growth and electrification in transport and industry.

More specifically, baseload power is becoming more expensive because of the economic displacement effect of intermittent renewable energy. Regardless of how much wind and solar (or even hydro) is connected to the grid, reliability and availability considerations mean the grid has to be fully supported by dispatchable generation such as nuclear, coal and, increasingly, gas.

However, customer preference for renewable energy (and its low operational costs) means fleets of dispatchable power plants operate at reduced capacity, with an increasing number on standby. Grid operators — and, ultimately, power consumers — still need to pay for the capital costs and upkeep of this redundant capacity, to guarantee grid security.

IT power consumption will need to be curbed

High energy prices, carbon reporting, grid capacity shortfalls and efficiency issues have been, almost exclusively, a matter of concern for facility operators. But facility operators have now passed the point of diminishing returns, with greater intervention delivering fewer and fewer benefits. In contrast, every watt saved by IT reduces pressures elsewhere. Reporting requirements will, sooner or later, shed light on the vast potential for greater energy efficiency (or, to take a harsher view, expose the full extent of wasted energy) currently hidden in IT infrastructure.

For these reasons, other stakeholders in the data center industry are likely to call upon IT infrastructure buyers and vendors to engage more deeply in these conversations, and to commit to major initiatives. These demands will be completely justified: currently, IT has considerable scope for delivering improved power management and energy efficiency, where required.

Architecting IT infrastructure to deliver improved energy efficiency through better hardware configuration choices, dynamic workload consolidation practices and the use of power-management features (including energy-saving states and power throttling / capping features) — will deliver major energy-efficiency gains. Server utilization, and the inherent efficiency of server hardware, are two key dials that could bring manifold improvements in energy performance compared with typical enterprise IT.

These efficiency gains are not just theoretical: web technology and cloud services operators exploit them wherever they can. There is no reason why other organizations cannot adopt some of these practices and move closer to the performance metrics achievable. In an era of ever-more expensive (and scarce) power resources, together with mounting regulatory pressure, it will be increasingly difficult for IT C-level managers to deny calls to engage in the battle for better energy efficiency.

The full report Five data center predictions for 2023 is available to here.

See our Five Data Center Predictions for 2023 webinar here.

Daniel Bizo

Douglas Donnellan

Getty Images

Getty Images

2020

2020