Eyeing an uptick in edge data center demand

Edge data centers are generally small data center facilities — designed for IT workloads up to a few hundred kilowatts — that process data closer to the population of local end users and devices. Earlier in 2021, we surveyed data center owners/operators and product and service suppliers to gauge demand and deployments. The findings were consistent: Data center end-user organizations and suppliers alike expect an uptick in edge data center demand in the near term.

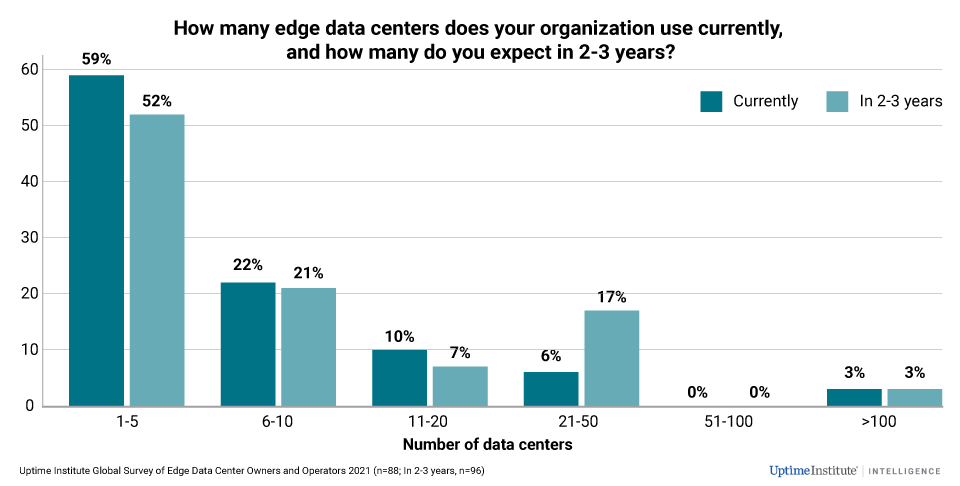

The study suggests a small majority of owners/operators today use between one and five edge data centers and that this is unlikely to change in the next two to three years. This is likely an indicator of overall demand for edge computing — most organizations have some requirement for edge, but do not expect this to change significantly in the short term.

Many others, however, do expect growth. The share of owners/operators that do not use any edge data centers drops from 31% today to 12% in two to three years’ time — indicating a significant increase in owner/operator uptake. Furthermore, the portion of owners/operators in our study using more than 20 edge data centers today is expected to double in the next two to three years (from 9% today to 20% in two to three years), as shown in Figure 1.

Over 90% of respondents in North America are planning to use more than five edge data centers in two to three years’ time, a far higher proportion than the 30% to 60% of respondents in other regions. The largest portion of owners/operators planning to use more than 20 edge data centers within the next few years is in the US and Canada, closely followed by Asia-Pacific and China.

The main drivers for edge data center expansion are a need to reduce latency to improve or add new IT services, as well as requirements to reduce network costs and/or bandwidth constraints in data transport over wide distances.

Uptime Institute’s research shows that large deployments of hundreds or more edge data centers are expected for many applications, including telecom networks, the internet of things in oil and gas, retail, cloud gaming, video streaming, public transportation systems, and the growth of large international industrial companies with multiple offices. Several large-scale edge data center projects are today at a prototyping stage with trials planned using one to 10 sites. Full-scale deployments involving tens of sites are planned for the coming three years.

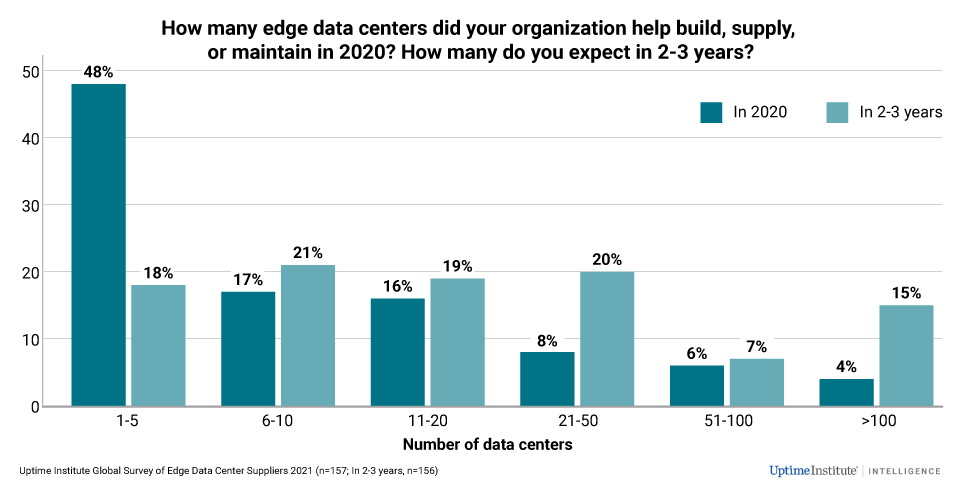

The view from suppliers of edge data centers in our study was similarly strong. Most suppliers are today helping to build, supply or maintain between six and 10 edge data centers per year. Many expect this will grow to 21 to 50 annually in two to three years’ time, as shown in Figure 2. The portion of suppliers that built, supplied or maintained more than 100 edge data centers in the year 2020 is minimal today; looking ahead two to three years, 15% of suppliers in our study expect they will be handling 100+ edge data center projects (a threefold increase from today).

Suppliers in the US and Canada are particularly bullish; almost one in three (32%) expect a yearly volume of more than 100 edge data centers in two to three years’ time. Those in Europe are also optimistic; roughly one-fifth of suppliers (18%) expect an annual volume of more than 100 edge data centers in the coming two to three years. Some suppliers report a recent change in market demand, with orders and tenders going from being sporadic and for a single-digit number of sites, to more requests for larger projects with tens of sites. The change may be attributed to a solidification of clients’ corporate strategy for edge computing.

It seems clear that demand for edge data centers is expected to grow across the world in the near term and especially in North America. Owners, operators and suppliers alike anticipate growth across different industry verticals. The digitization effects of COVID-19, the expansion by big clouds to the edge, and the mostly speculative deployments of 5G are among key factors driving demand. However, there is complexity involved in developing edge business cases and it is not yet clear that any single use case will drive edge data centers in high volumes.

The full report Demand and speculation fuel edge buildout is available here.

UI 2020

UI 2020